- Persuade & Raise

- Posts

- ♞ Ace Mobility Deck Breakdown

♞ Ace Mobility Deck Breakdown

Hey Persuaders!

Today, we will look at a subscriber’s deck that was sent to me.

Want to get your deck reviewed? For $49.99 I will review your deck in the newsletter. Reply now to get a review and have your company shared with 25,000+ subscribers (including hundreds of VCs).

The design here isn’t ideal, but the content is all here. No real significant changes required, but this is one of the few times that I’d recommend bringing in a designer to fix this up.

This is a great perspective framer; it doesn’t fit the mould of a traditional perspective framer, but generally speaking, one of the biggest things that investors want to see is that you have a connection to the problem, which will help you remain connected to the company and motivated to work even when things get tough. This does that job while also creating a lens through which to interpret the deck.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Strong problem slide that also maintains the connection to the perspective framer and wider story that the founder is trying to tell.

Again, this is a great slide. It uses the rule of threes to narrow down the wider societal/personal problem to three specific problems that the company can solve.

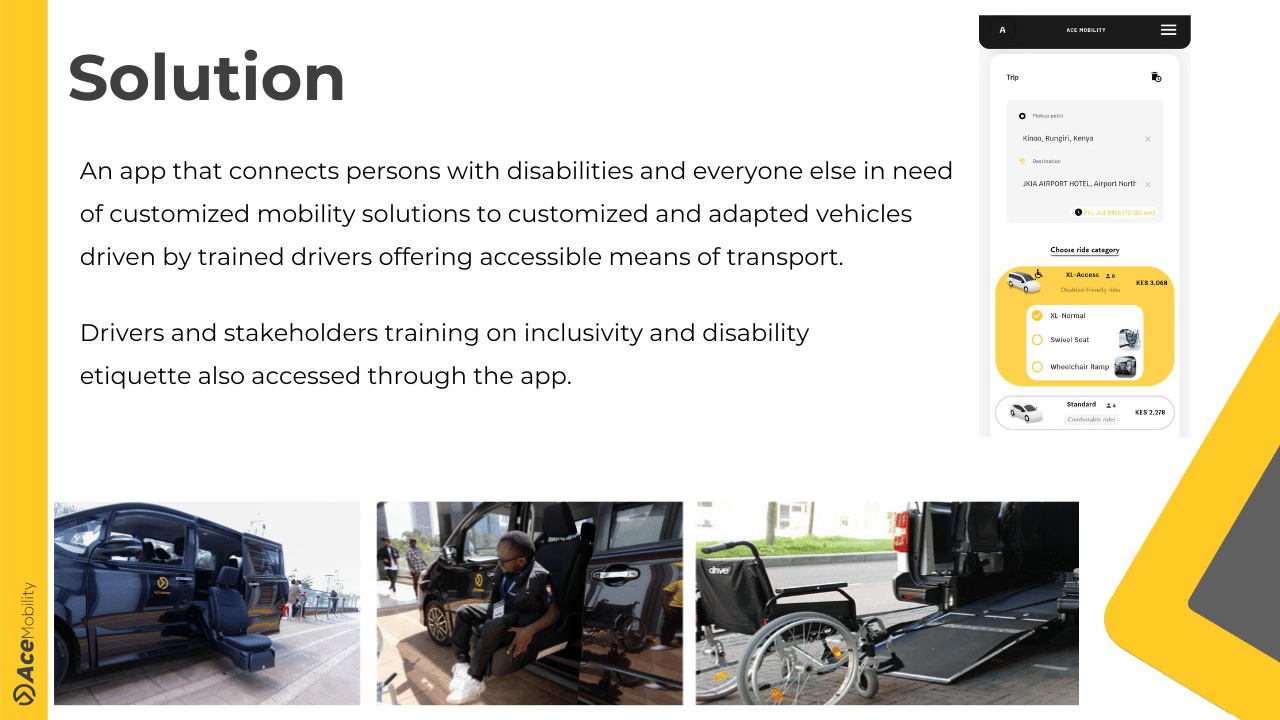

This is a clear solution. The only criticism is that if you take the time to point out three very specific pain points (as was done on the slide above), then you should be able to address how you solve those problems on this slide.

This is good placement for the traction slide. Unfortunately, the traction isn’t excellent here, but this is where you need to be able to show that there is market acceptance of your idea.

This is the first major mistake. Although I often say not to address both sides of a “marketplace” directly, in this case, at this point in the deck, investors will have loads of questions about why someone would choose to drive for this service over Uber/Lyft. It is vital here that this is addressed directly.

Would you invest based on this deck? |

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Are you looking to grow your business? Here is how I can help:

📱 Book a Strategy Call to get 1:1 feedback on your pitch, pitch deck and/or fundraising strategy. (If you need general startup advice, then reply to this email, and I’ll let you know if/how I can help.)

Onwards and Upwards,

P.S. It would greatly help me if you could share the newsletter with more founders to help grow our community!