- Persuade & Raise

- Posts

- FTX Deck Breakdown

FTX Deck Breakdown

Hey Persuaders!

Unlike other pitch deck breakdowns, I am not going to go through this deck slide by slide in great depth. Instead, I will provide my analysis right off the top and then share the deck below with short comments.

Here are things to note as you review the deck:

This is the Series B deck, so it will be different from the Pre-Series-A decks that we normally analyze.

Because it’s a later-stage deck, the entire pitch is focused on growth. While an early-stage deck aims to balance potential and risk, later-stage decks are focused on showing (i) how big the opportunity is and (ii) how the company is already on a path to capture that market.

This deck is one large, coherent story. SBF was a great storyteller; this deck allowed him to raise $1B. Mimicking his skills and telling a single story with your deck will greatly assist you in raising.

The final slide here is unique as it provides an emotional conclusion to the growth story. This is quite unique and something I’ve only seen on a few decks (coincidentally this includes the Theranos deck).

Let’s get into it.

Slide 1: Introduction

Simple and clean. I’d recommend that earlier stage companies have at least one sentence to describe their business, but at a later stage, this works.

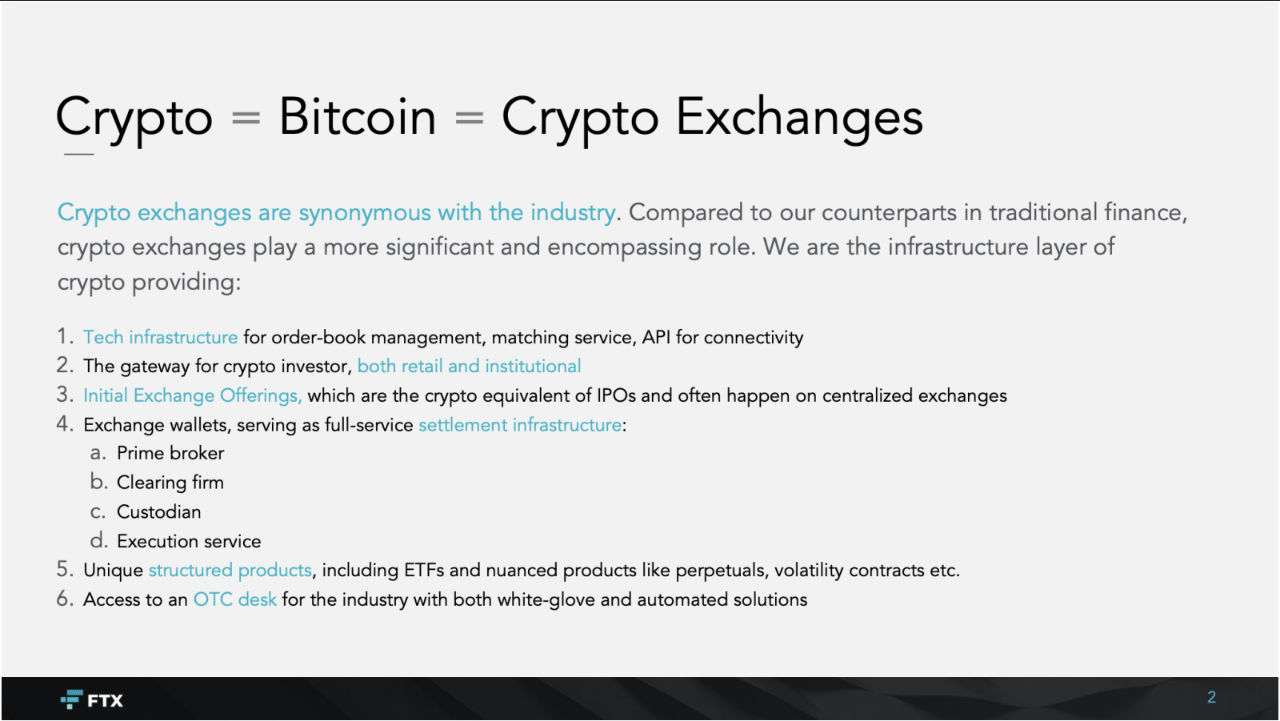

Slide 2: Overview

Straight into the growth story showing how they have grown and what they have achieved.

| Six CPE credits—and a chance to win an iPhone 15 The countdown to Controller Appreciation Week and BILL’s exclusive virtual finance event is on! Join us November 15-17 for Next in Finance: Automation, Acceleration, and Beyond. Attend for 6 CPE credits and a chance at an iPhone 15! Want more? How about an opportunity to win a complete Google smart home package just for registering? |

Slide 3: Potential

This slide may look complex, but it’s really about showing the potential; and how crypto exchanges can be bigger that their counterparts in traditional finance.

Slide 4: Potential

Showing where they are and where they can go.

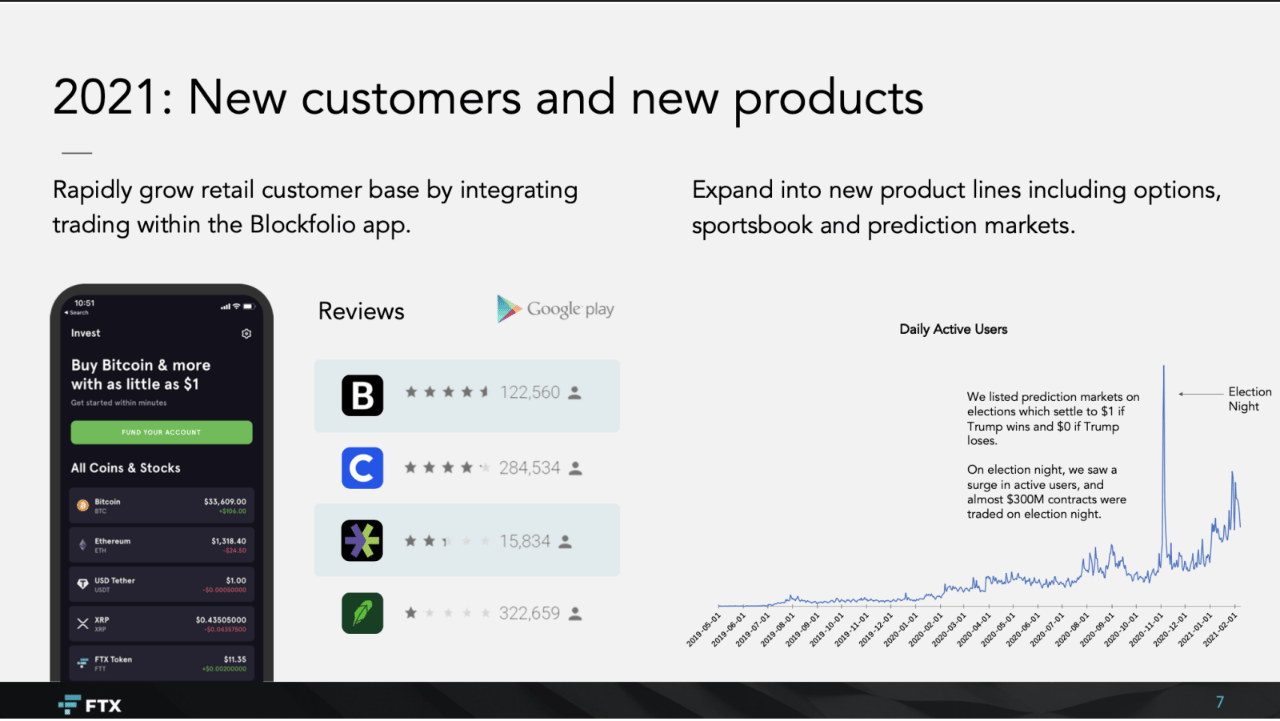

Slide 5: Growth

The growth story continues here…

Slide 6: Current State

Slide 7: Growth

Slide 8: Compliance (Growth)

This continues to show their growth strategy by showing how they are able to work with regulators.

Slide 9: Team

Slide 10: Closing Slide

They end the growth story by showing their end goal.

Would you have invested based on this deck? |

Are you looking to grow your business? Here is how I can help:

📢 Promote your startup to 2,000+ VCs including investors from a16z, YC, Techstars, Rarebreed, Sequoia and more.

📱 Book a Strategy Call to get 1:1 feedback on your pitch, pitch deck and/or fundraising strategy. (If you need general startup advice, then reply to this email, and I’ll let you know if/how I can help.)

📺 Access FundraiseOS, the ultimate fundraising course with video lessons and practical worksheets helping with everything from deciding how much to raise to understanding a term sheet.

💸 Promote your product or service to 100,000+ entrepreneurs.

🌐 Connect with me on LinkedIn or X (formerly Twitter) to get access to new content about startups, fundraising, venture capital and more every day.

Your continued support means a tremendous amount to me. Each person subscribed to this newsletter is trying to improve themselves and their business every day. Always remember that the best goal in life is to make sure every day is better than the last. Keep putting in the work, find the right mentors/advisors, and you will see the results!

Onwards and Upwards,

P.S. It would greatly help me if you could share the newsletter with more founders to help grow our community!

|